Disclosure :: This post is sponsored by Lafayette Pediatric Dentistry! Have you seen that they have a BRAND NEW office open?

The Truth About Dental Insurance

“But I have dental insurance…why do I have a bill?”

“But I have dental insurance…why do I have a bill?”

The short answer: Dental insurance does not function the way health insurance does. A significant majority of dental insurance companies offer policies that function more like stipends or small contributions towards dental care, instead of like comprehensive

coverage. In fact, legally, many dental insurance companies cannot even call their products true “insurance” for this reason. Additionally, a variety of exclusions and limitations apply with dental insurance that don’t exist with health insurance.

First, dental coverage is usually limited by annual maximums. Insurers will typically implement a $1000-$1500 maximum as far as how much dental care they will cover per year. This may be just fine if you only have minimum dental needs, such as just preventive care or a couple of small fillings. But let’s say you need more complex dental work, such as a crown and root canal? Or many fillings? Your maximum could be met well before half of your needs are taken care of! After that, everything is out of pocket.

An annual maximum of $1000-$1500 may have worked well back in the 1980’s, but not anymore! The cost of everything has gone way up since then, yet dental maximums have remained unchanged for 30+ years!

Second, dental needs aren’t always covered at 100%! Preventative care usually is, but basic dental work, like fillings, is usually covered at 70-80% of the cost, while coverage for “major” work, like crowns, drop to only 50% or less. It is therefore often difficult to find dentists who are in-network providers with more affordable or low-cost plans. Often the reimbursement is too low to maintain the costs of the treatment itself.

Well why is dental care so expensive? The cost of materials required to restore a tooth are very expensive. Plus, many different types of materials, and often custom lab work, are required to complete just one filling or crown or root canal. A typical dental office’s overhead is 65% of their expenses, compared to medical offices, whose overhead is usually lower, depending on the specialty.

So is there any point to keeping dental insurance at all? Maybe. Let’s say you need only cleanings and preventive care: most insurance plans cover this well, so purchasing dental insurance may be worth it. I say “may” because many people still end up paying way more on monthly premiums than they would if they just paid for their checkups out of pocket. The cost of getting two checkups per year is usually $350-500, including X-rays and cleanings. The average dental premium ranges from $360-720 annually. So policyholders paying on the higher end of that range could end up wasting almost $400/year just on just the premiums!

If you have more dental needs than preventative, insurance may help, but you could still be wasting a lot of money. Let’s say you have a dental checkup in early spring, where you discover you need a couple of crowns. Your annual maximum is $1500, which is the cost of one crown. Many dental insurances apply the cost of your 2 yearly checkups towards your annual maximum, which leaves even less coverage to apply towards any dental treatment like crowns or fillings. So in this scenario, you find that only some of the cost of one crown is covered, then after that everything is out of pocket. Then you continue to pay monthly premiums on your maxed out insurance for the rest of the year.

Sometimes these companies make you wait 6-8 months before being eligible for coverage. That’s enough time for a minor dental problem to become a major, more costly one! And if you already have urgent needs, like an abscessed tooth, being forced to wait can jeopardize your health!

Finally, all sorts of rules that apply to health insurance simply don’t apply to dental insurance. In many states, health insurance companies must legally spend 85% of the premiums they get from policy holders on the care they insure. This does not apply to dental insurance. With the exception of within the state of Massachusetts, dental insurance companies aren’t legally obligated to spend their premiums on patient care! In 2020, they only spent 25% of their profit on oral care. Dental coverage is still largely treated as something “elective” by corporations and insurers, but you as the consumer know

that dental care is a crucial component of everyday health care!

So what is the solution?

Many of our patients with costly dental insurance plans have found more sensible options in the following:

- Health Savings Accounts (HSA’s), where you set aside money to help with out of pocket

costs, much like you save for any other big expenditure. This way, you keep the money you set aside, instead of wasting money on monthly premiums that either isn’t necessary due to lack of extensive dental needs or doesn’t even cover the dental care you need.

costs, much like you save for any other big expenditure. This way, you keep the money you set aside, instead of wasting money on monthly premiums that either isn’t necessary due to lack of extensive dental needs or doesn’t even cover the dental care you need. - Flexible Spending Accounts (FSA’s): similar to HSA’s, where you can set aside a maximum of $2600 dollars for dental care each year, and you don’t pay taxes on that money.

- In-house dental savings plans—many offices, including ours, offer these. They offer discounts on preventative as well as operative dental care, with a much more sensible premium!

- Private financing companies like Care Credit, which function like a credit card for dental care and other out of pocket health related expenses.

- Focus on prevention. Make sure you come regularly for your 6 month checkups and cleanings, and continue excellent home care. Maintain a diet low in sugary snacks and beverages. A large number of dental treatment needs arise from lack of routine oral hygiene and preventive care, as well as poor dietary habits.

In short, there are some great insurance plans out there, and many not-so-great ones. It certainly helps to do the research before purchasing dental insurance, taking into consideration each family member’s individual dental needs. It may save you tons of money!

Lafayette Pediatric Dentistry offers an in-house dental savings plan that many parents have found to be a much better solution to dental insurance. Call the office at (337) 443-9944 for more information!

Website | Facebook | Instagram | Twitter

Other Dental Related Topics that May Be of Interest ::

- Why Does My Child Have White Spots on Their Teeth?

- What if My Kid Freaks Out at the Dentist?

- Tips on Weaning Your Little One From Thumb & Finger Sucking

- Sleep Disordered Breathing: More Common Than You Think!

- Why Take X-Rays Routinely at the Dentist?

- Teething Toddler Woes: Tips and Tricks For Relief

- The Most Common Causes of Cavities

- Four Reasons Moms Should Reconsider Fruit Snacks

- The Truth About Tongue and Lip-Ties

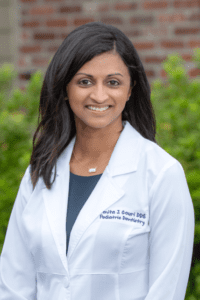

About the Author

Dr. Anita Gouri, a pediatric dentist, has been practicing in Lafayette for 10 years and is the owner of Lafayette Pediatric Dentistry. She graduated from LSU School of Dentistry in 2006, receiving honors including Outstanding Achievement in Pediatric Dentistry, Honors in Research, and the Carl A. Baldridge Academic Scholarship. She completed her residency in pediatric dentistry at Children’s National Medical Center in Washington DC in 2008 and became a board certified diplomate of the American Board of Pediatric Dentistry in 2009. In 2010, her research on dental pain assessment was published in Pediatric Dentistry. She also has specialized training in treating babies and children who have tongue and lip ties. She is a member of the Academy of Laser Dentistry, American Academy of Pediatric Dentistry, the Louisiana Dental Association, the Southwestern Society of Pediatric Dentistry, American Dental Association, as well as the C. Edmund Kells and Omicron Kappa Upsilon Dental Honor Societies. Dr. Gouri, her husband, and their two children enjoy travel, Saints football, good food and good friends.

Dr. Anita Gouri, a pediatric dentist, has been practicing in Lafayette for 10 years and is the owner of Lafayette Pediatric Dentistry. She graduated from LSU School of Dentistry in 2006, receiving honors including Outstanding Achievement in Pediatric Dentistry, Honors in Research, and the Carl A. Baldridge Academic Scholarship. She completed her residency in pediatric dentistry at Children’s National Medical Center in Washington DC in 2008 and became a board certified diplomate of the American Board of Pediatric Dentistry in 2009. In 2010, her research on dental pain assessment was published in Pediatric Dentistry. She also has specialized training in treating babies and children who have tongue and lip ties. She is a member of the Academy of Laser Dentistry, American Academy of Pediatric Dentistry, the Louisiana Dental Association, the Southwestern Society of Pediatric Dentistry, American Dental Association, as well as the C. Edmund Kells and Omicron Kappa Upsilon Dental Honor Societies. Dr. Gouri, her husband, and their two children enjoy travel, Saints football, good food and good friends.